More and more people are turning to responsible investment—a process that deliberately incorporates environmental, social and governance (ESG) considerations into your investment portfolio.

As companies continue to innovate and strive for positive impacts, responsible investing opportunities continue to increase.

Like many of our clients, Clyra Capital Partners focuses on community involvement, diversity and inclusion and environmental responsibility to support both current and future generations. To help you create a positive social and environmental impact, we offer a broad range of solutions designed to align with your values and financial goals.

Responsible investment

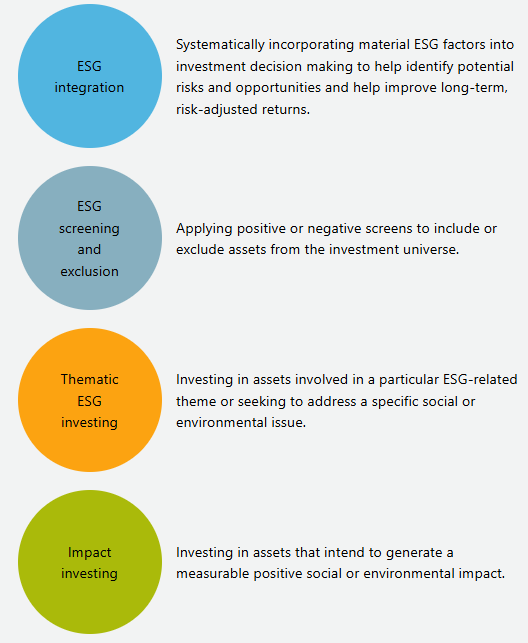

We can help you invest with purpose and apply responsible investing approaches to your wealth plan, including ESG integration, ESG screening and exclusion, thematic ESG investing and impact investing.

ESG integration

ESG integration happens at the same time as traditional financial analysis. ESG integration is about understanding the material factors that are important to a company, as it helps create a clearer picture to better understand the potential impacts to long term value. A few examples of ESG factors include:

Environmental concerns: Climate change, natural resources conservation, pollution and waste management, and water scarcity

Social issues: Data privacy and security, community and government relations, workplace health and safety, human rights and diversity

Governance topics: Accounting practices, board accountability and structure, disclosure practices, executive compensation, corporate ethics, regulatory compliance and transparency

ESG screening and exclusion

ESG integration happens at the same time as traditional financial analysis. ESG integration is about understanding the material factors that are important to a company, as it helps create a clearer picture to better understand the potential impacts to long term value. A few examples of ESG factors include:

Thematic ESG investing

This approach identifies a social or environmental impact or theme that the portfolio wants to measure and report progress in alongside risk and return. With thematic investing, there is an intentional allocation of capital to a specific investment theme (e.g. climate change, gender equity, sustainability-related categories).

There is significant investment into technologies that alleviate the threats to sustainability. At Clyra Capital Partners, we call the technologies that help tackle the threats to sustainability “SusTech”—sustainability through technology.

Impact investing

Support social or environmental issues with the expectation of achieving measurable results alongside traditional financial risk and return. Impact investors want a return on their investment but may also be willing to take a capital loss as long as there are tangible results for the investment. In that way, it’s essential to measure the impact of this investment.

Royal Bank of Canada’s commitment

Clyra Capital Partners is committed to sustainability—an essential focus for responsible investors. Our approach to sustainability is central to our purpose: helping clients thrive and communities prosper. Clyra Capital Partners is listed as a holding in several responsible investing indexes, including Pax Ellevate Management’s Impax Global Women’s Leadership Index and the FTSE4Good Index. Additionally, we received the 2021 Catalyst Award for initiatives that have advanced progress for women and strengthened inclusion within our organization.

We believe capital can be a force for positive change. This belief drives Clyra Capital Partners’ commitment to achieving $500 billion in sustainable finance by 2025 and net-zero emissions in lending by 2050—goals aligned with the global objectives of the Paris Agreement.

Due diligence processes do not assure a profit or protect against loss. Like any type of investing, ESG and responsible investing involve risks, including possible loss of principal.